Q1 2025 Northern Virginia Market Report

For additional statistics, download the full report

Market Overview

The Northern Virginia office market continued to face significant challenges in Q1 2025. With negative net absorption of 286,510 square feet for the quarter, the market remains under pressure, continuing to reflect the broader trend of weak tenant demand and the ongoing impact of hybrid work policies. This has contributed to continued softening in leasing activity and occupancy rates.

Overall rental rates declined moderately to $36.58/SF, representing a 2.8% decrease quarter-over-quarter but still a 5.1% increase year-over-year. Class A rental rates fell to $37.76/SF, marking a 3.3% decrease from the previous quarter. Additionally, Class B rents declined to $30.06/SF, reflecting a 1.6% decrease quarter-to-quarter. Vacancy rates remain elevated at 23.2% overall, with Class A vacancy at 27.2%. Class B buildings continue to perform better from an occupancy standpoint, with the asset type’s vacancy rate at 14.8%, a 8.4% difference compared to the broader market.

One of the quarter’s largest transactions was the Federal Deposit Insurance Corporation’s lease renewal for 171,044 square feet at 3701 N Fairfax Drive in the Virginia Square submarket. On the sales side, a joint venture between Westbrook Partners and American Real Estate Partners (AREP) sold two Class A office buildings—8401 and 8405 Greensboro Drive in McLean—to CIM Group, LP for $148 million ($317.78/SF). Known as Highline 1 and 2, the buildings total 465,727 square feet and illustrate the ongoing trend of selective investor activity at competitive pricing.

Quarterly Key Performance Indicators

- Net Absorption: (286,510) SF

- Direct Asking Rent: $36.58/SF

- Vacancy: 23.17%

Notable Regional Insights

- Return-to-office mandates from employers like Amazon and the federal government are boosting office occupancy and local business in Northern Virginia—signaling renewed optimism despite ongoing market challenges.

- The DOGE termination of nearly 700 federal leases is contributing to increased office vacancies and potential market instability.

Market Data

Occupancy Trends

While there were no major office deliveries in the first quarter of 2025, this comes on the heels of several notable completions in 2024 in the Northern Virginia office market. In November, George Mason University’s College of Business completed a 345,000 square-foot Class A building at 3401 Fairfax Drive in the Virginia Square submarket. This followed recent developments in the region, with Skanska delivering a 200,000 square-foot Class A building at 3901 N Fairfax Drive in the Ballston submarket in May. Additionally, the Reston submarket welcomed a significant addition in June with the completion of a 330,000-square-foot Class A office building at 1800 Reston Plaza Road. Despite these high-profile deliveries, the first quarter of 2025 showed ongoing challenges for the market. Net absorption for Q1 2025 totaled negative 286,510 square feet, with Class A properties continuing to struggle, contributing negative absorption of 282,809 square feet. This marks a reversal of the 238,000 square feet of positive absorption recorded in the previous quarter, reflecting the persistent weakness in the higher-end office space segment.

Construction Snapshot

Following nearly a decade of active development, the Northern Virginia office market’s development pipeline has sharply leveled off. This slowdown is primarily driven by unpredictable tenant demand, rising construction costs, new tariffs, and broader economic challenges. Amid the ongoing “flight-to-quality” trend in the commercial real estate market, the limited number of new Class A projects could create a ripple effect, potentially tightening this segment of the market for tenants seeking higher-quality spaces. As of Q1 2025, a total of 989,992 square feet is under construction, with 786,992 square feet coming from Class A buildings in the I-395 corridor, Merrifield, Reston, and Route 7 corridor submarkets. This marks a significant decline compared to the 2019 peak, when over 3.3 million square feet was under construction. Notably, one of the larger projects underway is 1880 Reston Row Plaza, a 210,000-square-foot Class A building in the Reston submarket.

Market Vacancy

The Northern Virginia office market continues to see a clear divide in performance between Class A and Class B properties. As of Q1 2025, Class B buildings maintain a lower average vacancy rate of 14.8%, while Class A properties are facing significantly higher vacancy at 27.2%. In the Ballston submarket, Class A buildings along North Fairfax Drive—eight properties in total—are collectively 47.4% vacant. A notable contributor is the 200,576-square-foot Class A office building at 3901 N Fairfax Drive, delivered in 2024, which remains 98.7% vacant. These large blocks of unleased space are contributing significantly to elevated vacancy rates in the Class A segment, where landlords continue to face challenges securing tenants amid ongoing uncertainty in demand.

Sublease Report

The sublease market in Northern Virginia continues to play a significant role in the overall office landscape. As of Q1 2025, there are approximately 300 sublease spaces available across the region, totaling around 4 million square feet of office space. Roughly 68% of these available subleases fall between 5,000 and 30,000 square feet, offering a range of flexible options for tenants. The Tysons Corner, R-B Corridor, and Reston/Herndon submarkets continue to dominate the sublease market, collectively accounting for 70% of the region’s total sublease inventory.

Sublease pricing remains competitive, with 46% of current offerings asking between $15.00 and $35.00 per square foot. Most sublease listings continue to be priced below direct market rates, placing additional pressure on landlords competing for tenants.

Significant activity occurred in the Reston submarket, where six new sublease spaces totaling just under 100,000 square feet were added. The National Landing submarket also saw increased activity, with four new sublease spaces totaling approximately 66,000 square feet added along Crystal Drive. The sublease market continues to tighten following a noticeable decline in inventory over the past year.

Quarterly Change in Sublease Availability

Distribution of Sublease Availabilities by SF

DOGE Lease Termination Analysis

Since DOGE (Department of Government Efficiency) began publishing lease termination data, the DMV region (D.C., Maryland, and Northern Virginia) has accounted for 29 terminated leases, totaling 1,753,406 square feet. These terminations translate to roughly $64.6 million in annual rent savings for the federal government. The bulk of the space reductions are concentrated in D.C., with several high-profile agencies pulling back from longstanding locations. This trend could lead to increasing vacancy rates in the affected submarkets, amplifying recent trends. Tenants stand to gain opportunity from what could be a softer market and additional space opportunities in previously limited or premium buildings - potentially with favorable lease terms as landlords look to backfill large blocks of vacancy.

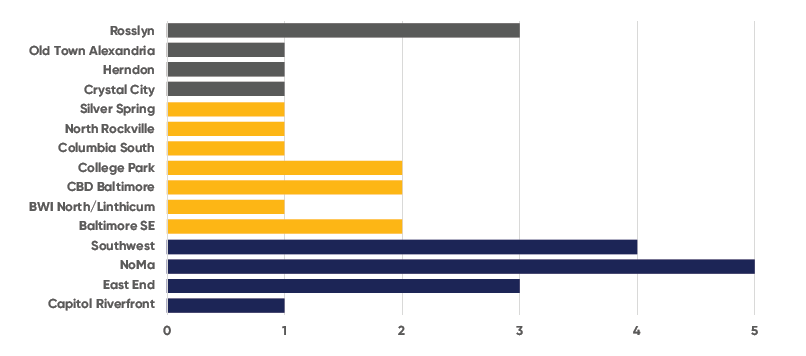

Number of Lease Terminations by Submarket

Top Submarkets by Terminated Square Footage

Download the full report to learn more.